Emerging Business Insights

Understand Your Experience Mod to Reduce Workers’ Comp Premiums

JULY 2, 2024

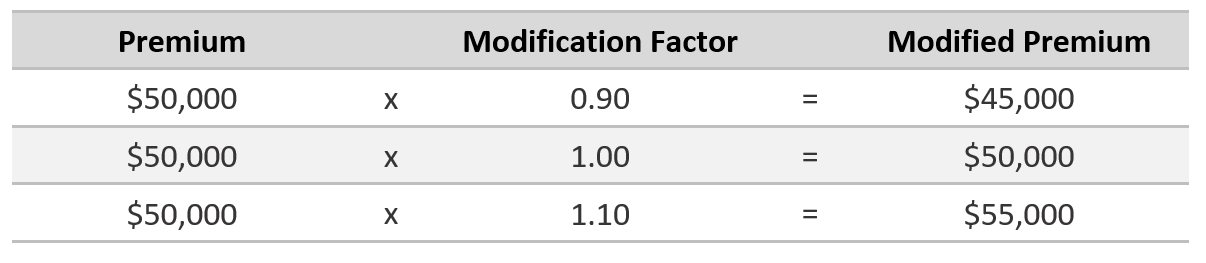

A business’s workers’ compensation experience modification factor, or experience mod, has a direct correlation with insurance premium costs. The experience mod is an indicator of the business’s loss history compared to that of its industry peers, and is used as a multiplier to either increase or decrease premium.

- An experience mod of 1.00 is reflective of average losses and does not affect the premium

- Lower than 1.00 represents better-than-average losses and produces a credit against the premium

- Higher than 1.00 represents worse-than-average losses and produces a debit against the premium

Job classifications, payroll and claims are the key components used to determine an experience mod. An error in any one of these can result in a higher premium.

To help them better understand how these components impact their premiums, USI Insurance Services conducts detailed experience mod reviews for clients. We also identify what type of injuries are driving their claims, so safety protocols can be developed and implemented. Armed with this information, businesses can gain control over their experience mod and potentially reduce premiums typically by 5% to 20% — and sometimes even more.

Many businesses believe that simply having an experience mod below 1.00 is the goal. But knowing how low it can be is important. The difference between the current experience mod and the minimum mod, a number unique to each business, represents the opportunity for further savings.

Although the process is complex, USI’s analysis can provide you with an edge over your competitors and ultimately lower your total cost of risk.

EXAMPLE

A general contractor was having a tough time qualifying for new work because their workers’ compensation experience mod was 1.13 — too high for the contracts they wanted to bid on.

When we verified their historical payroll amounts by worker classification and evaluated their open claims, we identified payroll errors and a claim reserve that was set too high. After pointing this error out and advocating on behalf of the contractor with the insurance company, we were able to reduce the e-mod from 1.13 to 0.98, creating a premium savings of almost $7,800. The reduced experience modification rating also allowed the contractor to bid on and win several new contracts worth over $4.3 million.

How USI Can Help

When your experience mod analysis is conducted by USI, we can

- Review and confirm your experience mod calculation is correct

- Identify the key claims driving your current e-mod, determine the financial impact of any standout claims and project future savings opportunities

- Determine the minimum e-mod specific to your business

- Analyze your business’s payroll, class codes and loss information from the past three years

- Help you develop a plan to improve the experience mod, which can reduce your premium by 5% to 20% or more

In addition to the experience modification analysis discussed in this article, USI’s analysis of workers’ compensation insurance programs can identify other opportunities to reduce exposure and create premium savings. To learn more about the risk management services available through USI, email select.business@usi.com.

SUBSCRIBE

Get USI insights delivered to your inbox monthly.